2024

simplification

flat rate

Indirect cost

direct staff costs

EIP

The use of simplified cost options can streamline administrative processes by reducing bureaucratic burdens both for beneficiaries and for Managing Authorities.

In the 2014-2020 programming period, under Finland's Rural Development Program, flat rate was applied for the implementation of the Knowledge transfer and information (M01), Basic services and village renewal in rural areas (M07), Cooperation (M16) and LAGs running costs and animation (sub)measures. The flat rate basis was the direct staff costs. The following costs were financed as flat rate costs:

Two options were available to applicants: 1) travel costs were reimbursed on a real costs basis and the flat rate was 15%. This was popular in remote regions where travel costs were high; 2) travel costs were included in the 24 % flat rate.

Concerning the Knowledge transfer and information (M01), Basic services and village renewal in rural areas (M07) and Cooperation (M16) measures, flat rate was used by 74,3% of the projects. All EIP projects applied flat rate, out of which 88% of them used the 24% option, while 12% used the 15% option.

The positive experience, the very few problems and the popularity based on major simplification justify the use of flat rate in the implementation of the CAP Strategic Plan 2021-2027.

In the 2021-2027 programming period 19% and 40% flat rate is allowed through the CAP Strategic Plan. The legal basis for both options is the Common Provisions Regulation (CPR). The modification in the flat rate value compared to the previous period (15% and 24%) was based on an external study ordered by the Finnish Ministry of Agriculture and Forestry to KPMG Ltd. The aim of the study was to elaborate methods and models of simplified cost options including flat rate and other options as well. The revision of the 15% and 24% flat rate model was also part of the study. Based on this study 19% and 40% flat rate model was selected by the Ministry. The study suggested to use not more than two alternatives, to keep it simple for the beneficiaries. This recommendation was agreed by the Ministry and the Paying Agency as well. The 19% flat rate is based on (EU) 1060/2021 Art. 53 and Art. 54.

Flat rate is used to cover indirect costs of an operation. According to Art. 54 indirect costs can be financed up to 25% of eligible direct cost, provided that the rate is calculated in accordance with point (a) of Article 53(3). So, a fair, equitable and verifiable calculation method is used based on (i) statistical data, other objective information or an expert judgement; (ii) the verified historical data of individual beneficiaries; (iii) the application of the usual cost accounting practices of individual beneficiaries.

The 40% flat rate is based on (EU) 1060/2021 Art. 56, which says that a flat rate of up to 40 % of eligible direct staff costs may be used to cover the remaining eligible costs of an operation. The Member State shall not be required to perform a calculation to determine the applicable rate.

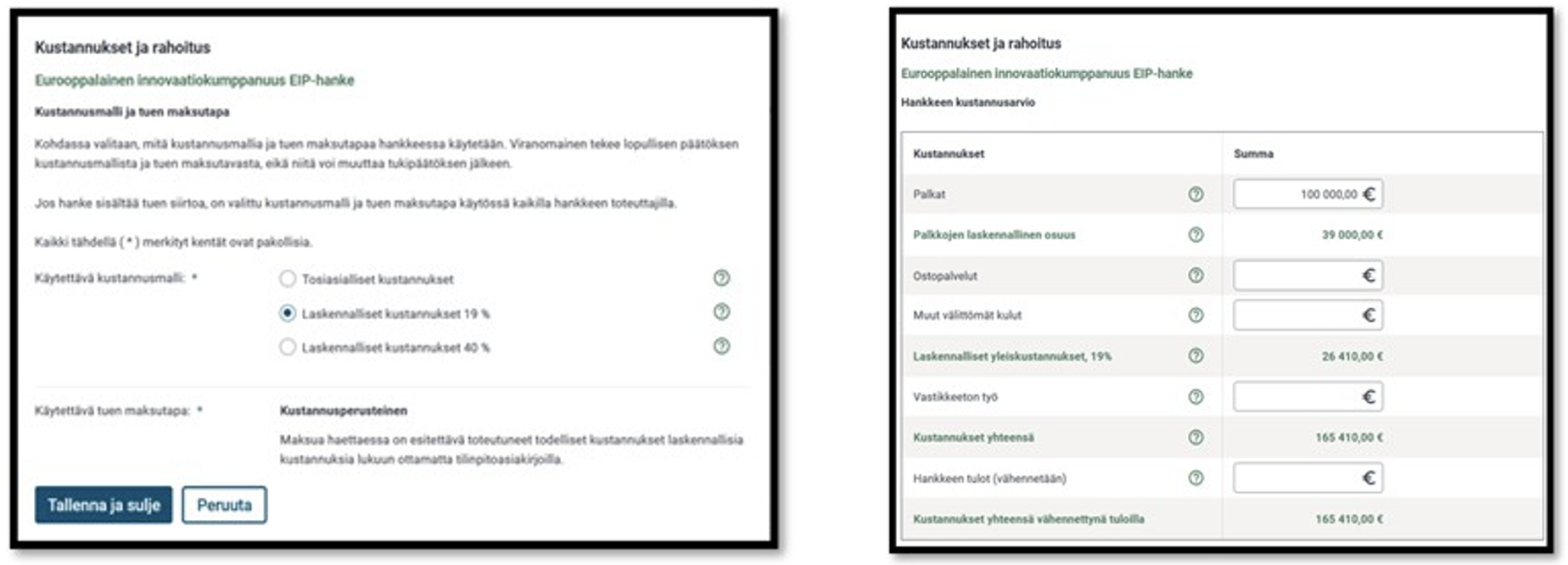

A new element introduced in the 2021-2027 period is that 5,000 euro preparation support can be applied by e.g. formulating EIP Operational Groups on a lump sum base. It is used for partner search and for preparing the application. Also new rule that the percentage for covering holiday pay, holiday compensation and employer's social security contributions is standard, 39 % in all cases.

The calculations are based on the application and payment data related to development and farms projects that ended in the 2014–2020 programming period as well as the financial statements of farms according to industry classification from Statistics Finland's database, including supported project beneficiaries.

Other data included information collected through various surveys, such as the employer's incidental costs, the collective agreements to be complied with, and the working time used for preparing the projects.

The study included the analysis of the composition of the direct and indirect costs as well as the detailed comparison of different flat rate options with conclusions. The models are based on the actual costs of the development projects. The final decision on the models to be applied was made by the Ministry.

Calculation steps and method for Model 1: 19% flat rate

Two different options were used to calculate the flat rate percentage, which gives the flat rate share in euros the same amount as in step 4 of the calculation.

Version b) was selected by the Ministry.

In the case of the 19% flat rate, the flat rate base is the staff costs (including holiday pay, holiday compensation and employer's social security contributions) and the services procurement costs. The flat rate covers the indirect costs such as:

Indirect costs are regulated in national legislation.

This option is suitable for measures 1 (training and information transfer) and 16 (collaboration) of development projects in situations where the share of salary costs is small and purchasing services play a significant role. This option is also suitable for measure 7 of development projects (development of rural services and villages).

There is no such calculation for Model 2: 40 % flat rate. However, calculations above showed that the median share of personnel costs of development projects in the total costs of the project is 58.9 %. The use of flat rate 40 % option is advocated if the project does not have a significant amount of service purchase, other direct costs or travel costs. It is suitable for measures 1 (training and information transfer) and 16 (cooperation) of development projects, where personnel costs are on average slightly more than 60% of the total costs of the project. This option is not suitable for measure 7 of the development projects (development of rural services and villages), where the average wage costs are significantly lower than measures 1 and 16.

The administration of the 40% flat rate model is very simple. The flat rate base is the staff costs (including holiday pay, holiday compensation and employer's social security contributions). The flat rate cost covers all costs other than staff costs.

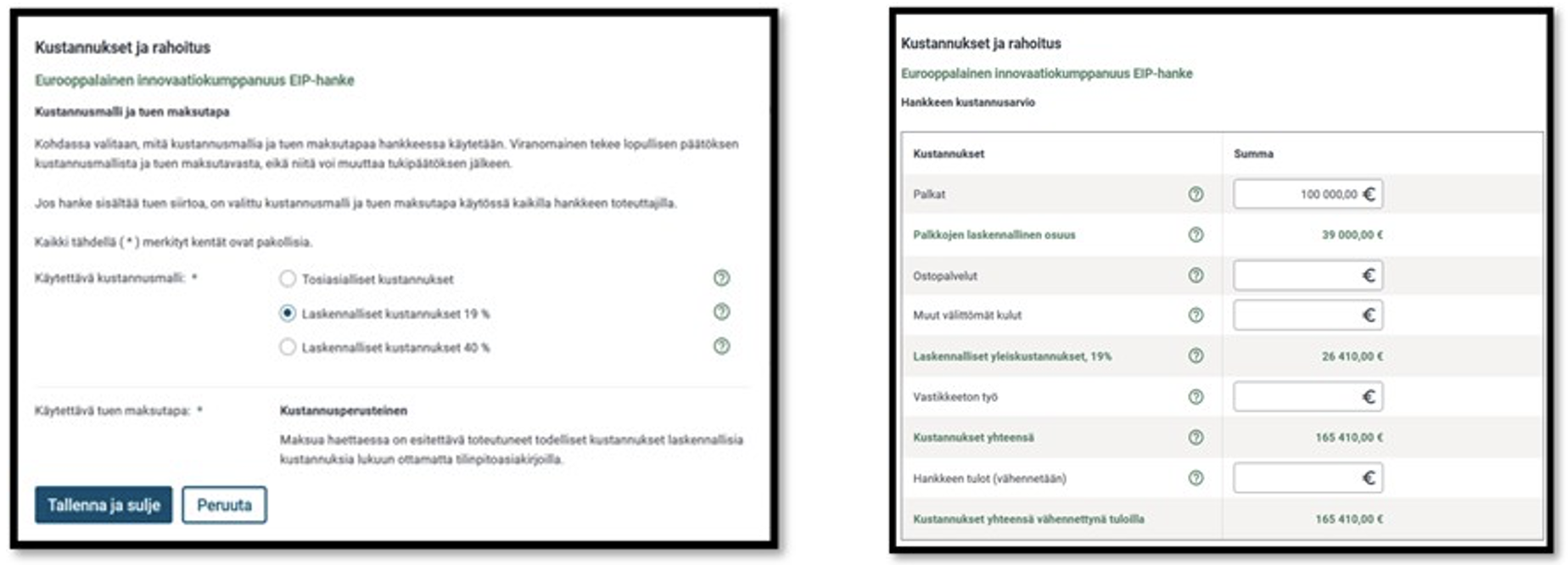

Applicants can choose between the real cost based and the two flat rate-based methods.

The granting authority makes the decision on the cost model for the entire project implementation period.

IT-system calculates automatically the percentage for covering holiday pay, holiday compensation and employer's social security contributions and the share of chosen flat rate (Fig. 1)

Figure 1: Finnish IT-system